The average price for Oman Crude Oil Future Contracts at the Dubai Mercantile Exchange (DME) witnessed a price drop by 0.7 per cent in August, compared with corresponding figures for July, according the monthly report of the Ministry of Oil and Gas (MOG).

The official selling price for Oman crude oil during August 2018, for the delivery month of October 2018, settled at $72.64, which was lower by 53 cents compared with July trading prices. The trading price ranged between $70.00 per barrel and $76.29 per barrel, the report said.

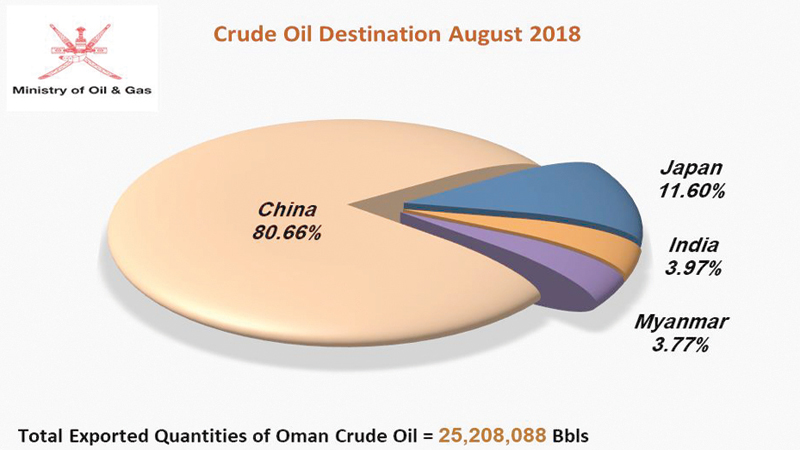

The Sultanate’s production of crude oil and condensate throughout August 2018 amounted to 30,209,500 barrels, representing a daily average of 974,500 barrels. Oman crude oil exports during August 2018 reached 25,208,088 barrels, representing a daily average of 813,164 barrels.

The proportion of China’s import of Omani crude oil declined 2.85 per cent to 80.66 per cent, compared to that of July 2018. It remained however at the top of the importing countries of Oman crude export. In contrast, imports by Japan rose 3.39 per cent on m/m basis, whilst imports by Myanmar fell by 0.36 per cent. Imports by buyers in the Indian-Subcontinent remained stable.

Crude Oil Prices witnessed a fallback during August 2018 futures trading compared with July 2018 for the major crude oil benchmarks around the world.

The average price for West Texas Intermediate crude oil at the New York Mercantile Exchange (NYMEX) reached $67.27 per barrel, down $2.23 compared with the previous month’s trading. While the average price for North Sea Brent mix at the Intercontinental Exchange (ICE) in London amounted to $73.84 per barrel, down by $1.11 compared with July 2018.

The crude oil prices’ downtrend through August 2018 was attributed to several factors that negatively affected trading settlements.

The shift-up in United States oil inventories, and the escalating trade dispute between the United States of America and China, have squeezed the oil markets.

Where these trade tensions threaten the volume of China’s import of US crude oil and therefore slowing the Chinese demand.

The negative trend in oil prices also harmed by the rise of the dollar exchange rate, which leads to the weakening of other commodities priced in the US currency, such as crude oil.

Oman Observer is now on the WhatsApp channel. Click here