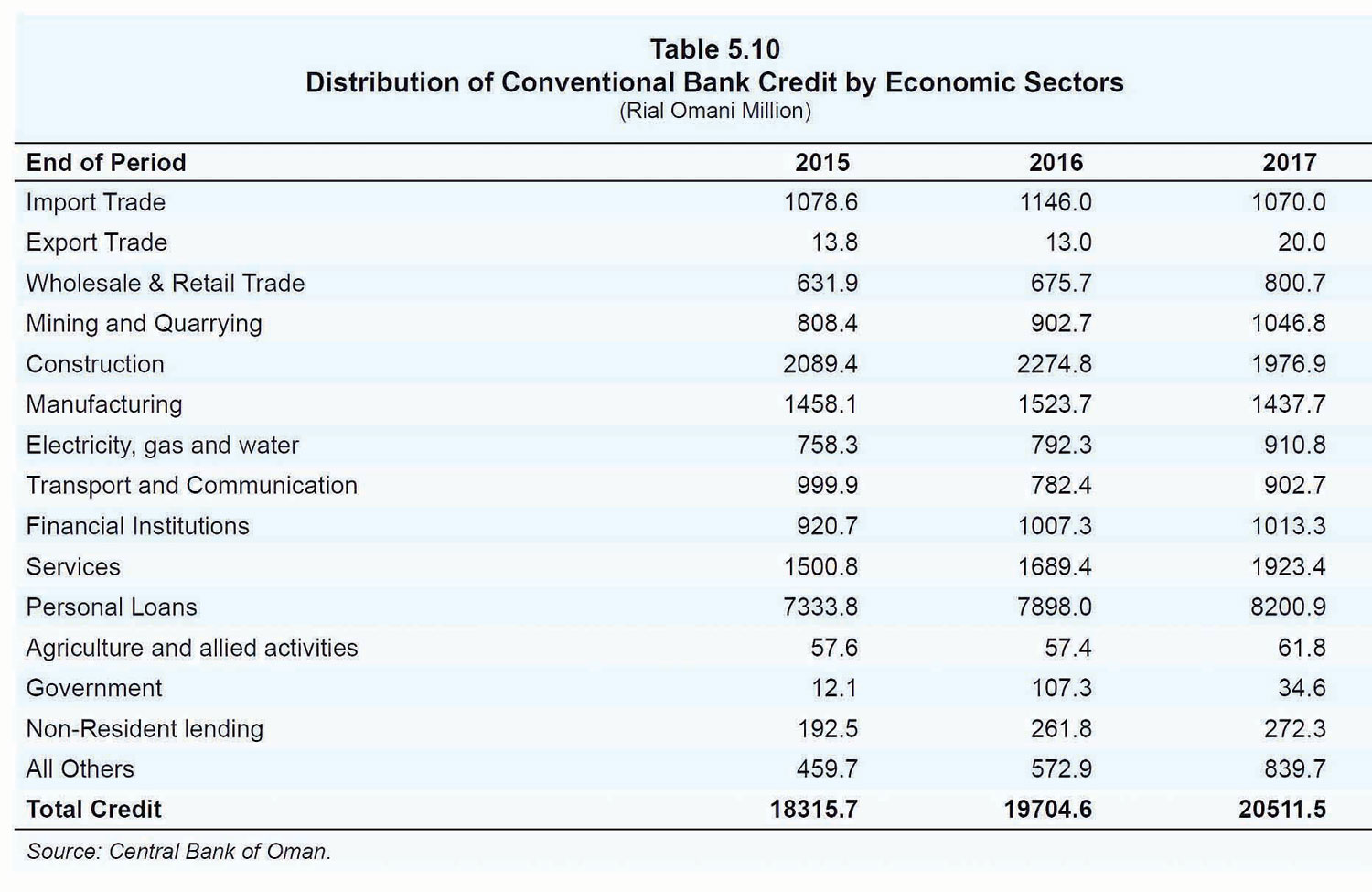

MUSCAT, AUG 11 - Commercial banks in the Sultanate handed out RO 8.2 billion in personal loans during 2017, representing 40 per cent of total credit extended last year, according to the Central Bank of Oman (CBO). The apex bank has capped personal loans, which includes residential housing loans, at 40 per cent of total credit portfolio of each lender. They account for a dominant share of total credit extended by local banks, far surpassing credit extended to other key economic sectors, such as construction, manufacturing, Oil & Gas, and services.

While still staying within the 40 per cent cap, personal loans have grown from RO 7.333 billion in 2015 to RO 7.898 billion in 2016. “On an incremental basis, the flow of credit to the personal loan segment led to an additional net credit outlay of RO 302.9 million during 2017,” the Central Bank noted in its 2017 Annual Report. Within the personal loan segment, residential housing loans stood at 10.8 per cent of the total credit portfolio of banks, but well within the sub limit of 15 per cent ceiling stipulated by CBO, the bank said.

The next big beneficiary of credit was the Construction sector with a 9.6 per cent share of total credit (RO 1.976 billion), followed by the Services sector at 9.4 per cent (RO 1.923 billion). In third place was Manufacturing with a 7 per cent share (RO 1.437 billion). Total credit extended by banks accounted for 73.5 per cent of total assets and registered an increase of 4.1 per cent over the year to RO 20.5 billion in 2017. The growth in credit was mainly driven by credit to the private sector which increased by 3.8 per cent to RO 18.2 billion.

Total deposits held with conventional banks increased 1.9 per cent to RO 18.6 billion 2017. “Apart from setting a ceiling on the quantum of personal loans that an individual bank can extend as a proportion of its total credit portfolio, and requiring banks to support SMEs by disbursing at least 5 per cent of their total credit, the CBO does not set any other target for priority sector lending,” the apex bank noted.

Conrad Prabhu

Oman Observer is now on the WhatsApp channel. Click here