National Oil companies (NOCs) must take a holistic approach to the oil and gas value chain to fuel economic development, according to a recent study by management consultancy Strategy & Middle East (formerly Booz & Company), part of the PwC network. Recent oil price volatility, coupled with an uncertain outlook for global oil and gas markets, is putting pressure on NOCs to maximise the overall benefit of hydrocarbon resources by pursuing an integrated policy towards the management of their portfolio of operations.

The study reveals that NOCs across the maturity spectrum have typically developed their oil and gas production, refining, and petrochemicals portfolios as a series of semi-autonomous assets and companies. But with an increasingly volatile market outlook and pressure to align with wider national objectives, the challenge for NOCs is to move their focus away from single elements and towards greater integrated portfolio management. This requires companies to address a number of barriers that often reflect legacy ways of working, including:

n Fragmented, incomplete, or inconsistent data

n Diverse, non-standardised planning and portfolio management tools and systems

n Rigid organisational silos that focus on the individual organisation entity, rather than the NOC as a whole

n Key performance metrics that incentivise operations within only one organisational entity

n Limited capabilities to resolve cross-organisational and cross-functional issues

n Culture and behaviours that discourage collaboration

Commenting on the challenges faced by NOCs, Georges Chehade, Partner with Strategy& Middle East, said: “NOCs increasingly have a mandate that goes beyond profitability to support the broader development of the non-oil economy and job creation. As a result, the model of semi-autonomous operating assets managed primarily to meet ambitious production and output targets has changed for good.”

In the GCC, for example, mature NOCs in Abu Dhabi and Qatar, have embarked on the merger of previously stand-alone joint ventures, whilst the need to make better use of capital is one factor behind the partial privatisation of non-core operations in Abu Dhabi and Saudi Arabia.

The Strategy& Middle East report identifies two complementary measures to help NOCs overcome barriers to integrated portfolio management:

1) Establish an integrated planning and capital allocation capability:

This approach starts with the strategic objectives of the NOC as the key driver along with an explicit consideration of how each element of the value chain will support them. This is in contrast to typical NOC planning policies that often consider the operational needs of the assets. With an integrated planning approach, for example, financial and operational resources are allocated on the basis of priority, rather than bottom-up operational need, to those assets and activities that best support fulfilment of strategic objectives.

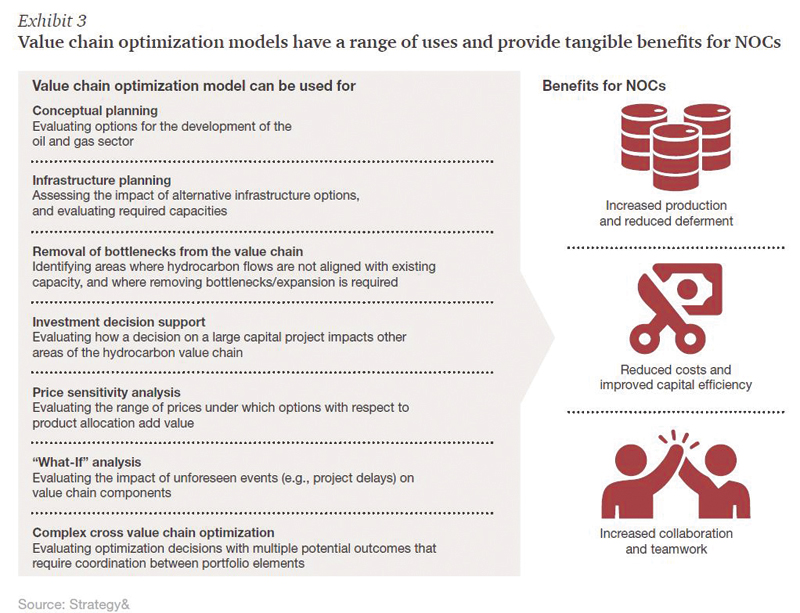

2) Develop new models to evaluate options for optimising operations across the value chain

The development of a value chain optimisation model starts with the mapping of the physical network of infrastructure and the actual and planned flows of oil, gas, and other products across the network. The second step is to identify the key nodes where alternative options for the allocation of hydrocarbons exist, or are feasible, for example in the allocation of crude oil to domestic refining or to export.

The third step involves converting the network into a numerical model that includes all key information required to develop scenarios and test the impact of different scenarios on the portfolio.

Oman Observer is now on the WhatsApp channel. Click here