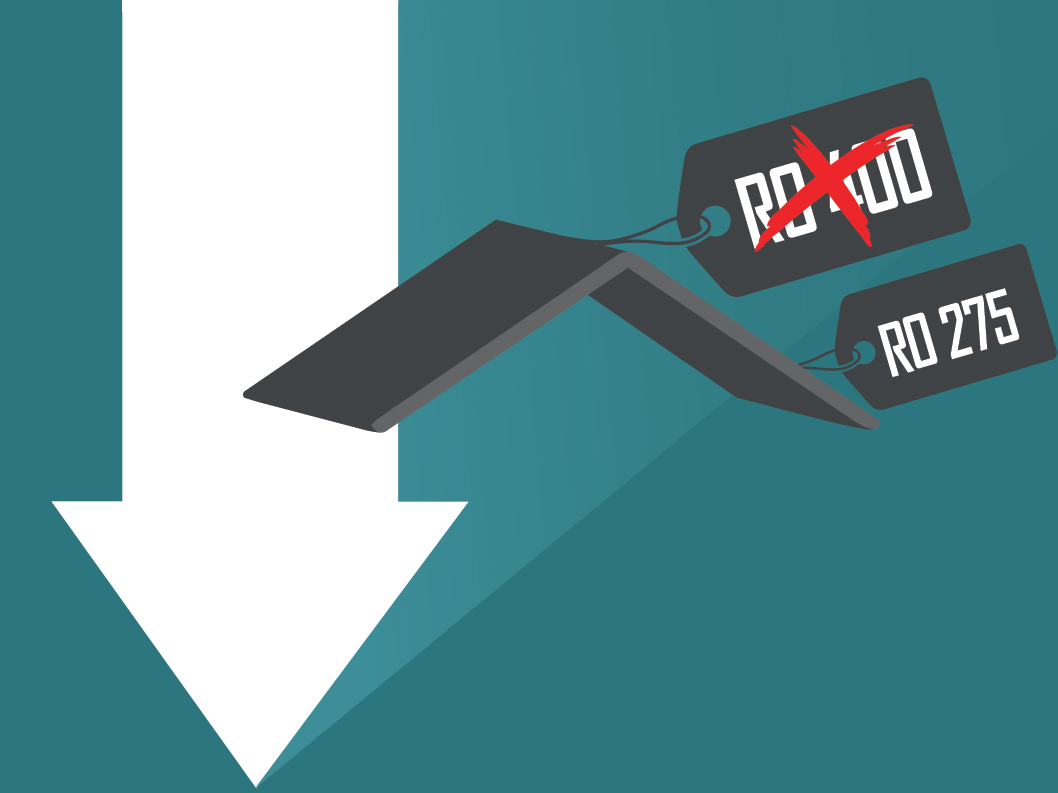

By Samuel Kutty — MUSCAT: MARCH 4 - On the back of a downturn in residential rent values and supply outstripping demand, tenants are now on the drivers’ seats with more negotiating power. Till recently, landlords dictated the rent. The situation has changed now with more flexibility both in rents and contract terms, say property analysts and owners. About a few years ago, demand was very high that landlords enjoyed more control over rental negotiations. Tenants then had to fork out a huge amount to rent a house in many areas in the capital city. When Observer dialed a ‘for rent’ number, the landlord offered a three-bedroom flat at as low as RO 275 in Ruwi. The flat, which has been vacant for more than six months, was rented at RO 400 a few years back.

A flood of new properties coming onto the market and departure of expatriates have been identified as the reasons of the rental drop. “The situation has changed now. Availability of flats and villas has increased manifold with supply outstripping demand. Residents are looking at how they can minimise their expenses as the lowest as possible”, said Saif bin Salem al Wahaibi, partner of a contracting company in Ruwi. The economic downturn has brought obvious challenges as companies are trying to adjust to the market conditions by reducing headcount and housing allowances, he said. Tenants are either handing in their keys because they can’t afford to pay rent anymore or they are renegotiating both their rent and their rental payment terms.

According to Saif, there was a time when companies and individual tenants accepted terms without negotiating hard. They had to stand up to landlords to provide accommodation to their employees. “Earlier, employers either directly leased buildings to be given to their employees or paid housing allowances separately. “As the labour force evolved and human resources departments have started to lump housing benefits into salaries, employees look for flats at lower rates so that they could save some money on that count”, said Saif. There is a disproportion between demand and supply, said Ibrahim al Balushi, a real estate broker.

“Over the last couple of years, there has seen a large supply of new quality apartments amid a fall in demand in areas like Ruwi, Muscat, Darsait, Al Wadi Al Kabeer, Wadi Adai and other adjoining areas where there already exist several hundreds of old buildings”, he said.

Also most buildings are being constructed with bank loans that they cannot be kept empty, he said, adding, no landlords want an empty property on their hands at present.

However, the fact is that the current market has seen a power change with tenants dictating more favourable terms, he said.

“The tenants now control the rent as they are the ones helping as pay the bank instalments against our loans. If they don’t like the price of rent they will just go and look at another flat and we cannot do anything about that. There have options open before

them”, said Raheed al Ruzaiqi, a house owner.

According to Joachim, a Jordanian, high rent is becoming story of the past.

“Rental prices were quite high for a long time in the past. Now they have come down. I believe it will be further down in view of the large number of new housing units available here.

According to Cluttons, average rental rates fell by a further 2.3 per cent during the third quarter of 2016, bringing total decline for the year to 8.1 per cent for Oman’s residential market.

The weakest performing residential sub-market was Shatti al Qurum, where rents fell 21.1 per cent, followed by Sur al Hadid and Qurum witnessing 20.8 and 7.9 pc fall, respectively.

Oman Observer is now on the WhatsApp channel. Click here