The hospitality market across the MENA region witnessed marginal growth in 2017, according to the latest Middle East Hotel Benchmark Survey Report from EY. Except for Egypt and Kuwait, the region’s hospitality markets witnessed a decrease in RevPAR due to factors such as increased supply, regulatory changes and ongoing reforms in the macro-economic environment.

During 2017, the Dubai market registered the highest RevPAR of $189, followed by Jeddah, which registered a RevPAR of $170. Dubai also had the highest occupancy rate in 2017 at 77.7 per cent with Abu Dhabi following closely at 77.1 per cent. The highest room rates of the year were recorded in Saudi Arabia, with an average daily rate of $300 in Mecca and Jeddah averaging at $266. Cairo’s hospitality market experienced a growth across all KPIs in 2017, resulting in the highest increase in room yield compared to 2016 and a RevPAR of 77.7 per cent, due to continued political stability in the country.

The Middle East Hotel Benchmark Survey Report, produced by EY, provides a monthly and year-to-date performance overview of leading hotels in the Middle East. The hotel set includes international branded and operated properties across the five-star and four-star segments.

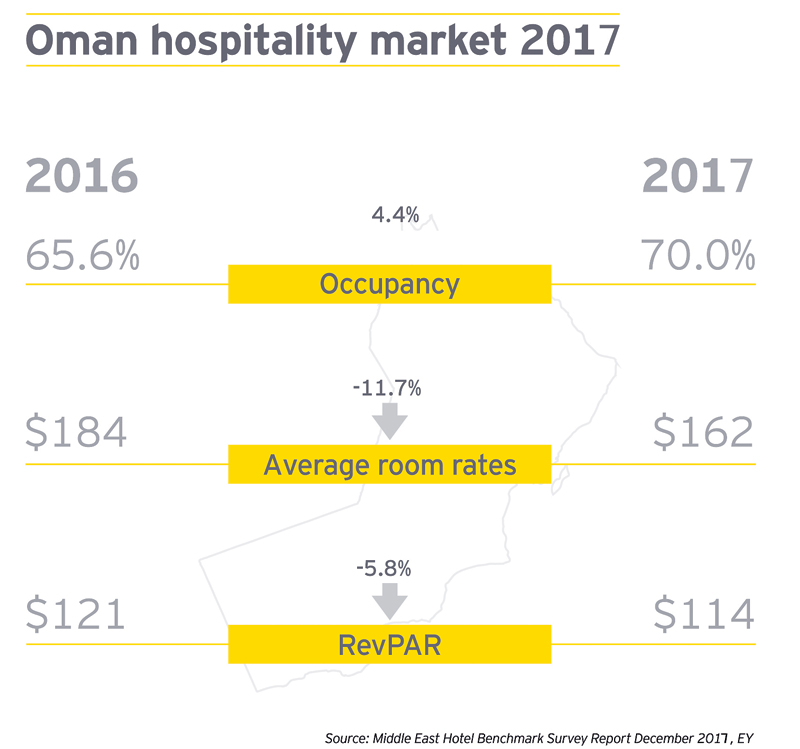

Muscat’s hospitality market witnessed a 4.4 per cent increase in its occupancy from 2016 to 2017. However, average room rates fell by 11.7 per cent from $184 in 2016 to $162 in 2017 leading to an overall average room yield of $114 in 2017, a 5.8 per cent drop from $121 in 2016.

Yousef Wahbah, MENA Real Estate, Hospitality and Construction Sector Leader, says: “The MENA hospitality sector may have seen marginal growth in 2017, but the announcement of several new hotels, government initiatives and the development of several mega projects will help drive tourism in 2018.

“In the UAE, the growth in hospitality supply will be sustained by an increase in occupancy through demand from existing markets and new source markets. Government initiatives such as the expansion of the visa on arrival status to Russian, Chinese, and Indian citizens will help increase visitor numbers and support the diverse hospitality offerings coming to market not only in Dubai and Abu Dhabi, but Ras Al Khaimah and Fujairah as well.

“In Saudi Arabia, government initiatives have paved the way for increased leisure tourism from both international and domestic markets. Recent announcements from the Public Investment Fund (PIF) include entertainment venues, theme parks, and large-scale hospitality and leisure destinations that will eventually rival leading resort destinations around the world. In the short term, hospitality demand will be boosted by corporate travellers, tasked with helping deliver some of these mega developments throughout the Kingdom.

“Other countries in the MENA region, such as Bahrain and Egypt, have government-led initiatives to drive tourism in their markets. Bahrain aims to strengthen the development of two-way tourism between GCC countries. Egypt, which saw an increase across all KPIs last year, will benefit from the opening of two airports and continued government efforts to improve bilateral relations.”

Oman Observer is now on the WhatsApp channel. Click here