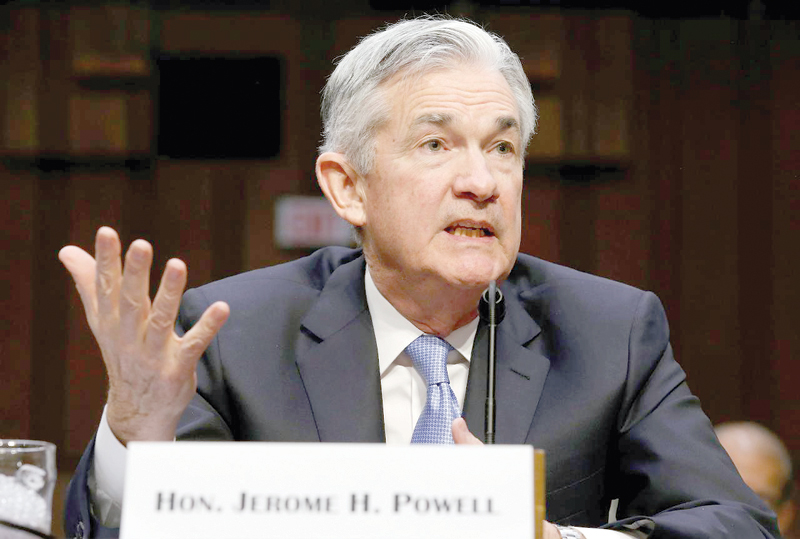

WASHINGTON: Federal Reserve Chairman Jerome Powell said the US economy does not appear to be running hot, even as the influential head of the New York Fed suggested a faster pace of interest rate increases may still be in the offing for 2018.

“There is no evidence the economy is overheating,” Powell told the Senate Banking Committee in his second appearance in Congress this week, saying he expects the Fed to stick with a “gradual” pace of monetary policy tightening.

But in remarks at an event in Sao Paulo, Brazil, New York Fed President William Dudley said “gradual” could still apply to a scenario in which borrowing costs were raised four times this year, instead of the three moves Fed policymakers projected when they issued their last set of economic projections in December.

Yet the Fed officials’ comments were overshadowed by President Donald Trump’s announcement of a plan to raise tariffs on steel and aluminium imports, the sort of move Fed policymakers have warned about since the Republican took office last year. Such action, and the risk of retaliation by trading partners, could cloud the US economic outlook and derail the global recovery currently benefiting the United States.

Traders of federal funds futures trimmed bets on a fourth rate increase this year after Trump’s announcement. US stock indexes fell sharply, with the S&P 500 index down about 1.3 per cent in a third consecutive day of losses.

In his testimony, Powell described trade as a “net positive” while conceding it created some losers in the economy, and said “the tariff approach is not the best approach.”

The Fed is expected to increase rates at its March 20-21 policy meeting. Policymakers will also issue fresh forecasts that will indicate whether the core of the rate-setting Federal Open Market Committee has shifted its view.

Powell’s twin appearances this week showed that he and the rest of the Fed are wrestling over how to square an economy that is strong on many levels, and possibly about to get at least a short-term boost from tax cuts, but still lacks the kind of inflation and wage gains that would prompt faster Fed action on rates.

To some policymakers, the absence of price pressures means the Fed should stand back, wait for wages to gain steam, and give workers a chance to make up ground lost due to the 2007-2009 financial crisis and its aftermath even at the risk of faster inflation in the future. — Reuters

Oman Observer is now on the WhatsApp channel. Click here