By Business Reporter — MUSCAT: APRIL 16 - Challenging market conditions have led to flexible, innovative and revised approaches from landlords across the capital in an effort to entice prospective tenants, according to leading international real estate consultancy, Cluttons. The Cluttons Muscat Spring 2017 Property Market Outlook has identified an increasing flexibility of finance terms, along with a deliberate focus on best-in-class property management services, as landlords work to ensure high occupancy rates at a time of weaker demand across the real estate market. Subdued economic activity across the Sultanate has also led to increased opportunity for tenants in the office market, as declining rental rates has led to office consolidation and migration to more affordable stock, the Cluttons report noted.

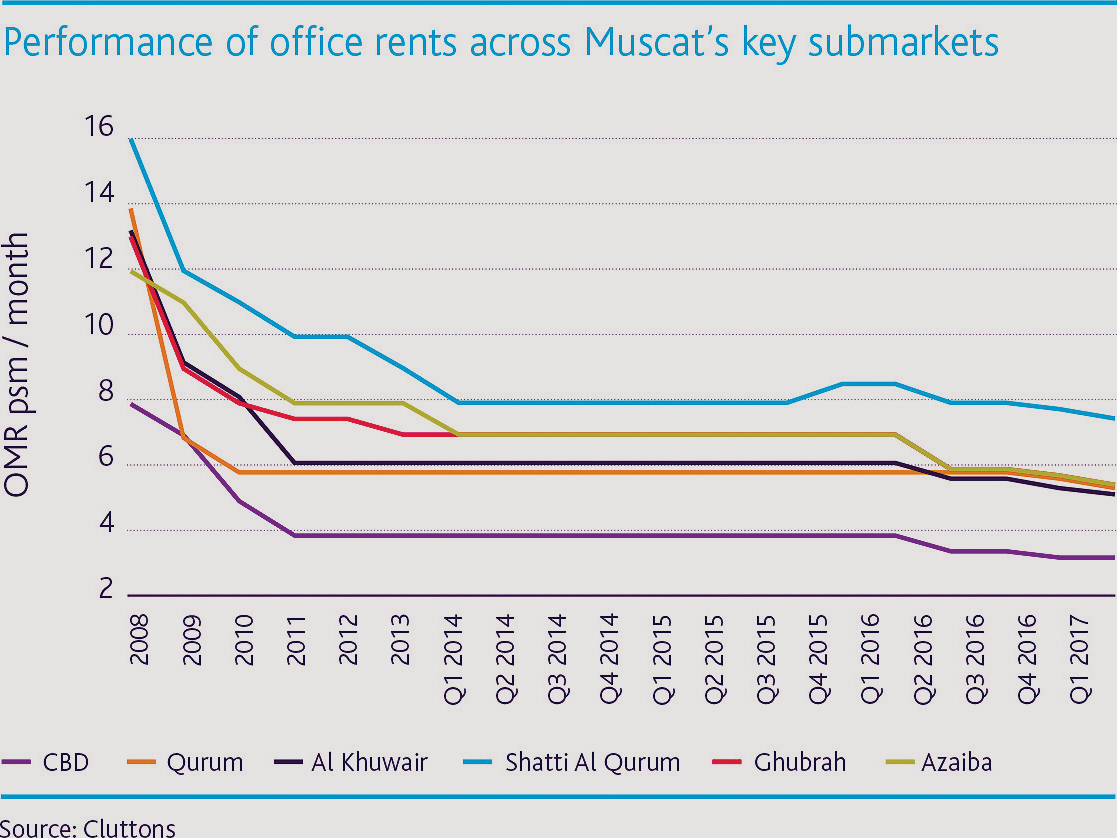

Cluttons’ latest report shows that during 2016, average rents across Muscat receded by 10.1 per cent, in line with the forecasts of previous Cluttons reports. During the final quarter of last year, rents declined by 4.2 per cent, leaving average monthly rents just shy of RO 700.

2017 has begun on a more stable start, with rents during the three months to the end of March declining, on average, by a marginal 0.6 per cent. The limited movement has improved the year on year change to -7.0 per cent; the best annual performance in 18 months, suggesting some locations may be starting to show signs of bottoming out.

Philip Paul, Head of Cluttons Oman, commented, “Increasingly, the work Cluttons’ team in Oman is focused on is the stabilisation, or boosting of revenue potential for landlords through professional management and active management of tenants, as landlords are increasingly recognising the need to be flexible. At the same time, tenants are aware of the opportunities for more value in the market, so those landlords that are taking a more proactive approach to the conditions are the ones best placed.”

“There are several properties that have retained high occupancy levels with little compromise on rental values. Al Assalah Towers, Hatat Complex, The Greens and Meydan Al Athaiba uphold 80 per cent to 100 per cent occupancy, due in no small part to the provision of facilities suited to market requirements. The most attractive residential developments tend to focus on inclusive, high quality complexes, with a property management approach dedicated to swiftly taking care of all tenant needs.”

Cluttons report highlights the importance being placed on high quality accommodation by the market by citing the example of the newly launched Taminat Complex by the Public Authority for Social Insurance, where 15 per cent of the units were leased within three weeks of coming to market.

Faisal Durrani, head of research at Cluttons noted: “With GDP growth forecast to slow to 0.4 per cent this year, from 1.5 per cent last year, the prospects for a sudden surge in job creation rates and subsequent increase in the level of requirements for rented accommodation remain low. That said, the slowing rate of rental declines in the first quarter suggests we may at last be starting to see the first signs of the market gradually bottoming out. It is perhaps too early to call the current conditions entirely stable as the weak signs of stability may be quickly upset by any shocks to the global economy, or indeed the local economy.

For now, our baseline view is for rents to dip back by between 5 per cent to 7 per cent during 2017, which assumes little change in rents over the next three quarters. This is arguably the most stable outlook for Muscat’s residential market in almost two years.”

Oman Observer is now on the WhatsApp channel. Click here