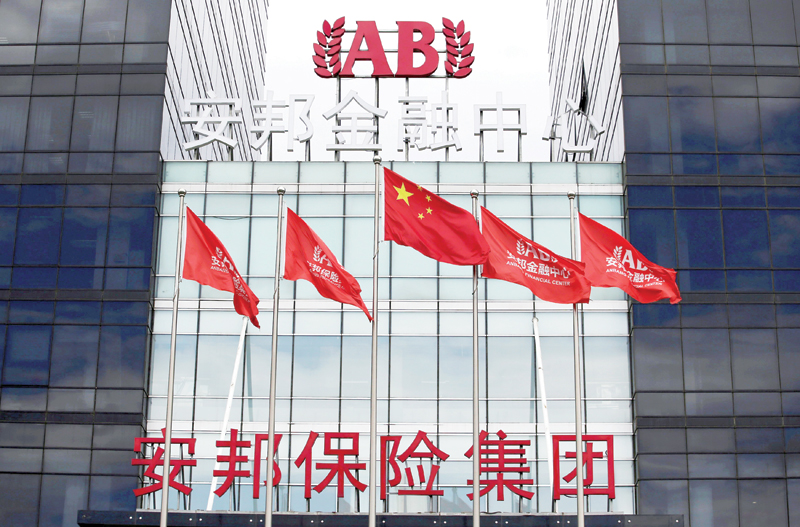

Beijing’s unprecedented takeover of private insurer Anbang confirms that toxic risks lurk in the world’s second-largest economy while signalling the state’s tightening grip on China Inc despite reform rhetoric, analysts said. Government regulators seized control of the Anbang Insurance Group, saying its debt-fuelled foreign acquisition binge left the company in financial peril and that high-flying founder and former chairman Wu Xiaohui would be prosecuted for fraud.

The takeover, to last at least a year, was the most striking step yet by regulators to rein in dizzying debt levels and a clear sign that the government saw something frightening in Anbang’s books.

“This move has huge significance. If something went wrong with Anbang it would lead to massive bad loans in the financial system,” said Beijing-based economist Hu Xingdou.

China has moved aggressively over the past year to slam the brakes on companies like Anbang, which ran up gargantuan debts to fund pricey overseas acquisitions.

Such companies have become known as “grey rhinos” —financial beasts that could charge quickly, with damaging results.

Despite expert warnings that China’s spiralling debt could spark a meltdown with global repercussions, the communist regime has steadfastly insisted that any risks remain controllable.

But a look under Anbang’s hood has clearly spooked Beijing, analysts say.

Anbang raked in cash largely by selling short-term policies promising some of the highest returns in the market, and rose from obscurity to quickly become one of China’s biggest insurers.

With the proceeds, the Beijing-based firm spent billions overseas, snapping up New York’s iconic Waldorf Astoria hotel in 2015 for nearly $2 billion, adding other pricey hotel and financial assets around the globe, and even making an aborted $15-billion bid for Starwood Hotels.

But Beijing’s clampdown on risky financial practices since 2016 crippled Anbang’s fund-raising.

“It’s a serious problem. There may now be a flood of redemptions coming through,” said Christopher Balding, a Peking University economics professor.

“If you are a $315-billion company like Anbang and have to write down even just 20 per cent of your assets, that’s almost a $100-billion hole. That’s big even by China’s standards.”

Many Anbang holdings look likely to be sold off. — Reuters

Oman Observer is now on the WhatsApp channel. Click here